RECOMMENDATION ON IPO

Recommendation for Listing Gain

- Not all IPOs will offer listing gain. Many will offer loss as well.

- Get recommendations for listing gains.

Main Board & SME IPOs

- The service will cover all BSE/NSE main board & SME IPOs for listing gain.

- Recommendation is not for long-term holding, rather only for listing day gain.

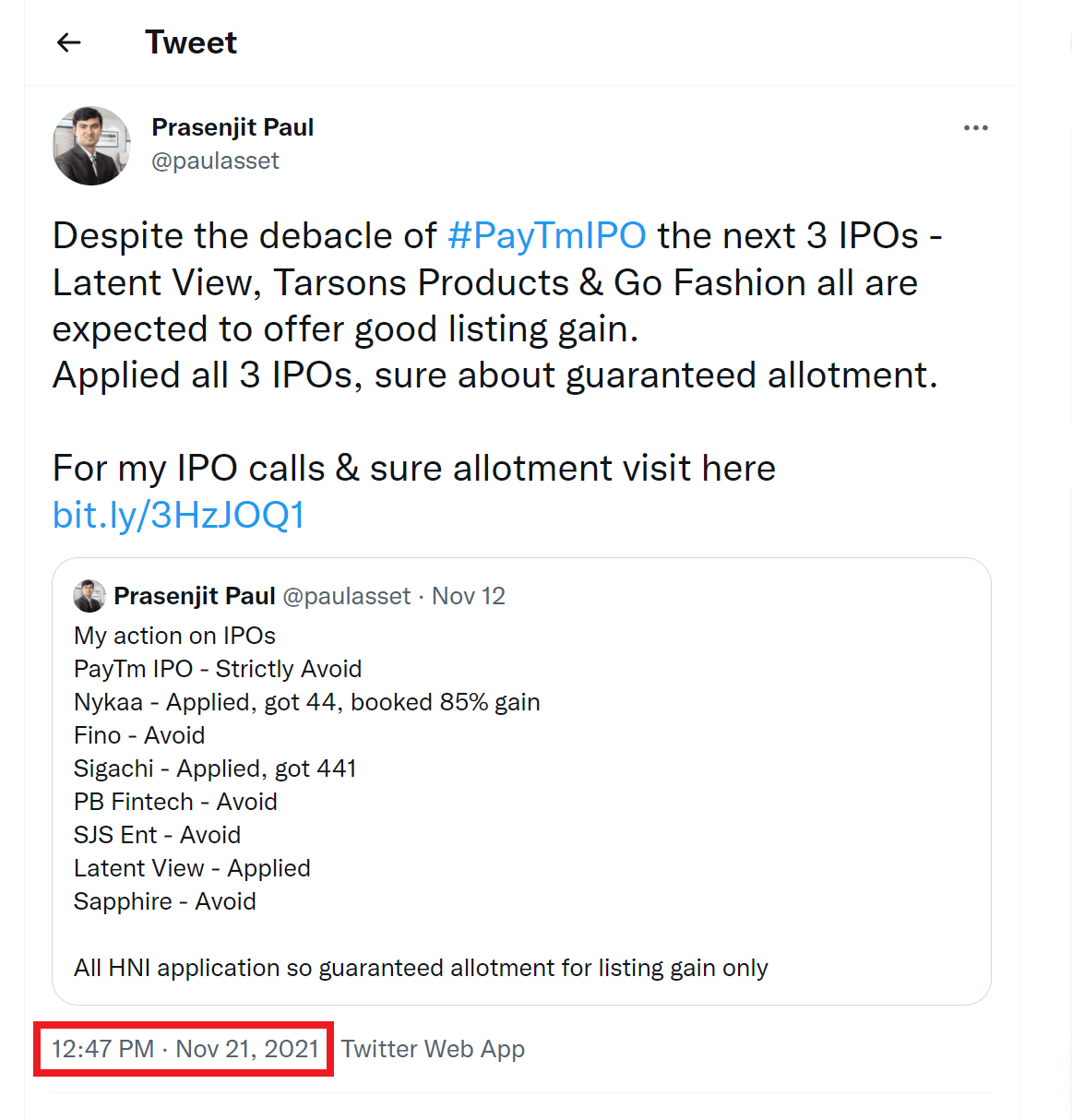

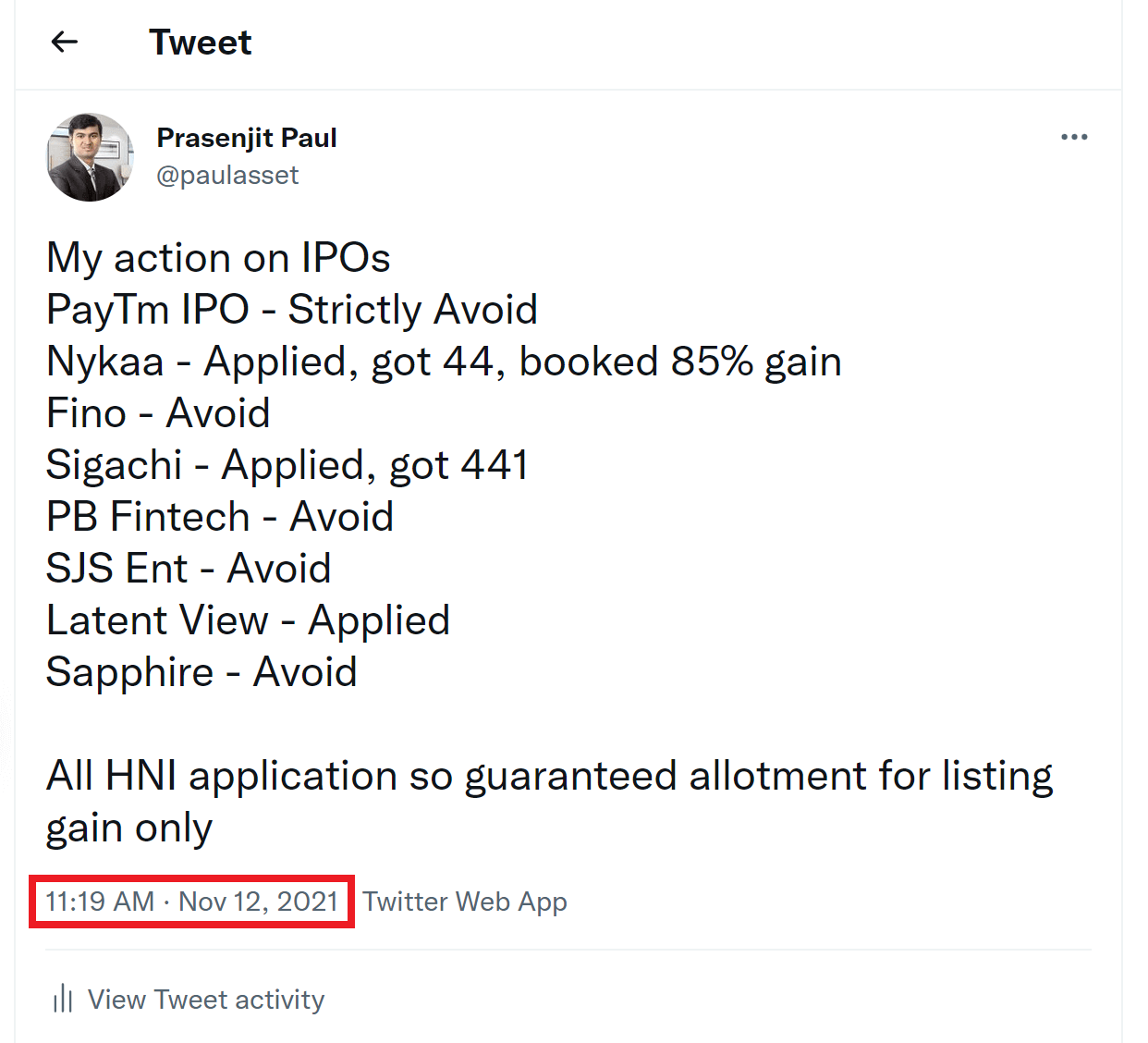

100% Tested Method:

- Long Track Record of Successful calls.

- Click here for the proof of all successful IPO calls.

Website Access & Email

- You will receive email & telegram alert.

- Website access will be also there to check recommendations on all past IPO calls.

FREQUENTLY ASKED QUESTIONS

-

When will you provide the IPO Recommendation?

We will share the IPO recommendation via email and after login section update prior to the last day of subscription. For example, if an IPO remains open for subscription from 10th to 12th, you will receive the recommendation on 11th. As we are more focused on increasing the accuracy of the call, so it is not possible to share recommendation before the subscription opens. We have a great success ratio only because we keenly observe a lot of moving parameters till Day 2 of subscription and then share our final call. Investors will have the entire day (last day) to bid for the IPO. There's no difference between bidding on day 1 or on day 3.

-

How many IPO calls one can expect?

The number of IPOs in any year varies according to market condition. Few years witness 50+ IPOs (Mainboard+SME), while a few years witness 10-20 IPOs. So the number of IPOs is not in our control.

-

What is your refund policy?

There is NO refund policy. Payment once made for the subscription won't be refunded. So kindly read this entire page carefully before subscribing.

SUCCESS ON ALL PAST IPO CALLS

Disclaimer - The service is not an offer to sell or solicitation to buy any securities. Prasenjit Kumar Paul will not be liable for any losses incurred or investment(s) made or decisions taken/or not taken based on the information provided herein.

The information contained herein does not constitute a personal recommendation or take into account the investment objectives, financial situations, or needs of individual investors. Before acting on any information, investors should consider whether it is suitable for their particular circumstances. Information herein is believed to be reliable but Prasenjit Kumar Paul does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. The performance data quoted represents past performance and does not guarantee future results.

The video series is based on researches and case studies gathered from different books, media, internet space, etc. Prasenjit Paul and the producers do not accept any responsibility or liability for the accuracy, content, completeness, legality or reliability of the information. The course is made solely for educational purposes and is not created with an intent to harm, injure or defame any person, body of persons, association, company or anyone. The course is not intended to spread rumours, offend, or hurt the sentiments of any religion, communities or individuals, or to bring disrepute to any person (living or dead). The viewer should always do their diligence and anyone who wishes to apply the ideas contained in this course takes full responsibility for it. Prasenjit Paul and the producers of the course disclaim any kind of claim of libel, slander or any kind of claim or suit of any sort. Viewers discretion is advised. This is not an offer to sell or solicitation to buy any securities or mutual funds and Prasenjit Kumar Paul will not be liable for any losses incurred or investment(s) made or decisions taken/or not taken based on the information provided herein. The information contained herein does not constitute a personal recommendation or take into account the investment objectives, financial situations, or needs of individual investors. Before acting on any information, investors should consider whether it is suitable for their particular circumstances. Information herein is believed to be reliable but Prasenjit Kumar Paul does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. Prasenjit Kumar Paul may hold shares in the company discussed herein. The performance data quoted represents past performance and does not guarantee future results.

This site is not a part of the Facebook™ website or Facebook™ Inc. Additionally, This site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc. As stipulated by law, we can not and do not make any guarantees about your ability to get results or earn any money with our ideas, information, tools or strategies. We just want to help you by giving great content, direction and strategies that worked well for us and our students and that we believe can move you forward. All of our terms, privacy policies and disclaimers for this program and website can be accessed via the link above. We feel transparency is important and we hold ourselves (and you) to a high standard of integrity.

Copyright © 2024 Prasenjit Paul. All Rights Reserved