High Volume Stocks Portfolio of Prasenjit Paul

(Equity Analyst & Best-Selling Author of “How to avoid loss and earn consistently in the stock market”)

Service Inclusions - What will you receive?

- I will share my Buy/Sell transaction details (high volume stocks) with percentage allocation from my personal portfolio. Whenever you join, you can access all the past data from the start of the service, December 2019. The service comes with a one-year validity period. Unless renewed, the access would be revoked after the expiry date.

- After subscription, in the "after login Dashboard" zone, you will find two left-hand-side menu - (1) "Transaction List" where I will share month wise buy/sell transactions with date, purchase/sell price and portfolio allocation (2) "Portfolio" where the consolidated portfolio, stock wise average purchase cost, allocation and cash holding percentage would be visible. Occasionally, I will also share general views/updates on my portfolio.

- Buy/Sell transactions would be shared on the same day (mostly within trading hours while market remains open) through email and telegram alert. The website would be updated accordingly.

Service Exclusions

- Kindly note that this is NOT a stock recommendation advisory service, rather just information sharing service thus no research report, no future prediction on price target etc would be provided, neither any kind of queries would be addressed. Publication of the research report restricts personal investment activities. Hence, the decision of not publishing research report. However, occassionally I can share my personal views/updates on my portfolio.

- There is no mandate for any of the subscribed member to buy/sell any stock. The service will just notify what Prasenjit Paul is buying and selling in his personal portfolio in his personal capacity.

- My Portfolio is primarily divided in two parts - 1. High Volume Stocks 2. Low Volume Microcap/Smallcap Stocks. Kindly note this service excludes transactions in smallcap/microcap multibagger potential portfolio.

My Investment Philosophy - What to Expect from My Portfolio?

- Fundamental Analysis Approach - I believe in the bottom-up fundamental analysis approach. I prefer an asset-light business model that can grow while maintaining a quality balance sheet with sufficient cash flow from operations and headed by professional quality management. It would have been better if the business has some competitive advantage or business moat or currently enjoying some business tailwind.

- Analytical Ratios - I prefer business having a debt-to-equity ratio of less than 1 (or decreasing), average ROE and ROCE of more than 12% (or increasing), comfortable working capital cycle, zero pledged shareholding and growth without excessive debt. I don't believe in any MS-Excel based valuation technique (like DCF method). I rely on many qualitative aspects while judging valuation.

- Short Term Profit Booking with Long Term Approach - Although, I select stocks keeping a long-term view in my mind but I don't hesitate short-term profit booking if the situation demands. If I feel the market is heated up or overall correction is pending, then I opt for profit booking to stay in cash position.

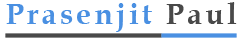

- Cutting down losers while increasing winners - Over 2012-2021, I have noticed around 70% success ratio in my stock selection i.e. I made money in 7 out of my 10 stocks. More than stock selection, it is the portfolio allocation that decides overall portfolio return. Thus, it is very important for cutting down losers while increasing allocation of winners. Over a period, I noticed that the more efficiently I cut down losers early, the better is my portfolio return.

- Stocks touching higher highs are preferred - I prefer staying away from stocks those are consistently touching new 52-week low, no matter how attractive the valuation is. On any given period, I prefer fundamentally strong stocks those are making new highs.

Follow My Portfolio (India)

- Buy-Sell Transaction details of Prasenjit Paul.

- Stock wise holding percentage with cash allocation.

- Same day transaction alert via email, telegram & web.

- No refund is applicable.

Pay Now

Small investor? Click here to check our Telegram Package

Testimonial

Frequently Asked Questions

-

How many stocks you hold in your portfolio? How many transactions I can expect?

Historically, I have seen that my portfolio mostly consists of 10-20 stocks across all market caps, which I consider as fairly diversified.There is no preset or a fixed number of monthly transactions I do in my portfolio. It all depends on the overall market situation and prevailing opportunities. Overall, I noticed that every year, I came across with 8-10 new stock addition in my portfolio with multiple partial or full profit booking.There is no guarantee that every year I must come across with the said number of stocks. For me, long-term investment doesn't mean buy, forget and do nothing, rather for me it is buy, review constantly, if the situation demands book partial/full profit and if not then only hold for the long term. After my purchase, if I find deteriorating fundamentals or any serious issue suddenly pops out, I don't hesitate booking loss as well. I believe that successful investing requires cutting losers early and sticking with winners.

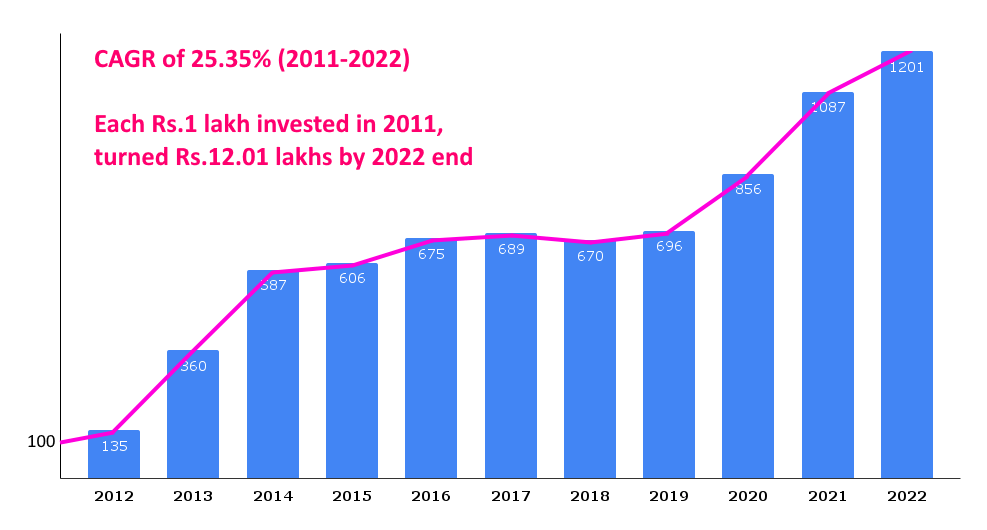

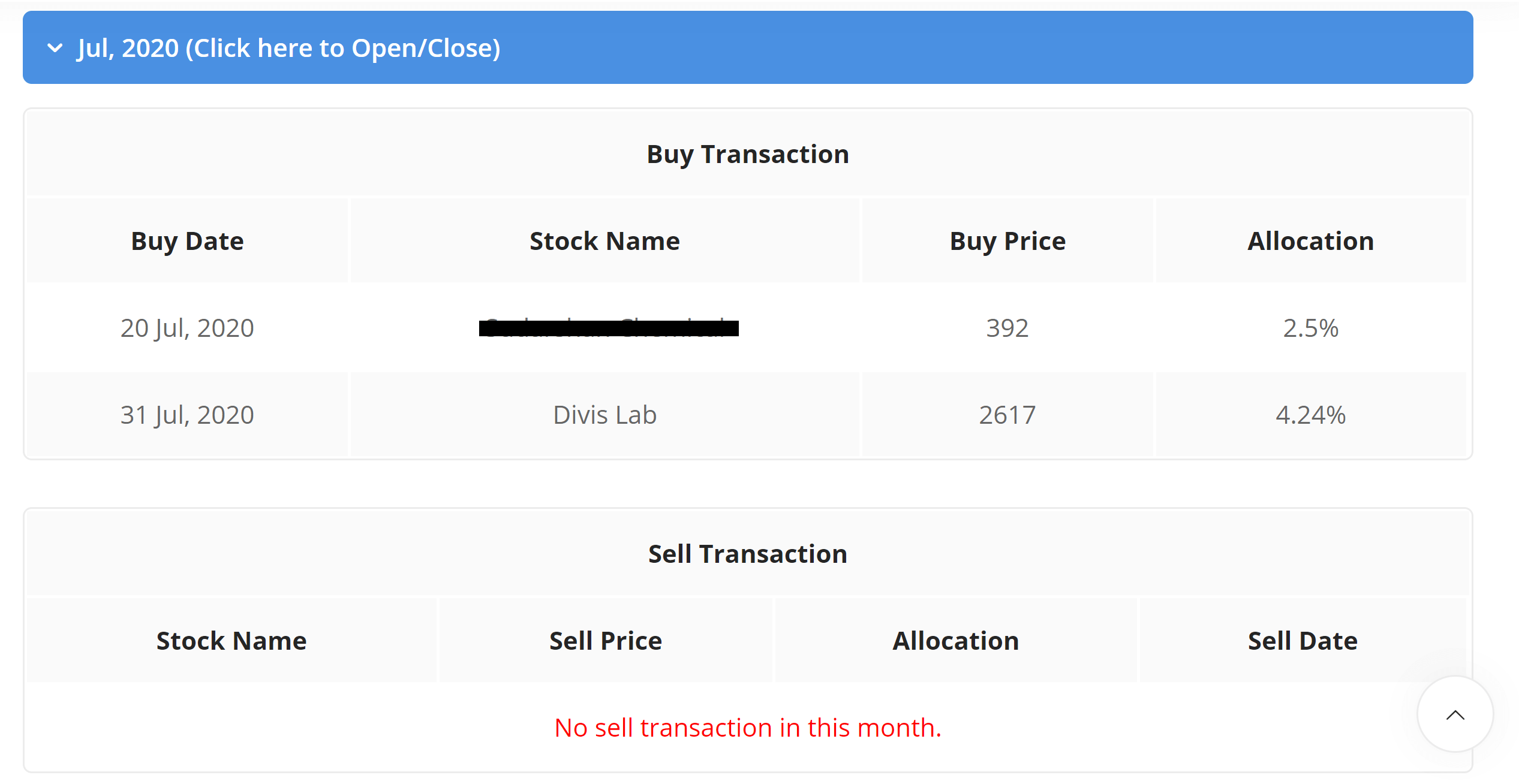

Following is the snapshot of the transaction list and portfolio of Prasenjit Paul -

-

Would you be sharing your complete portfolio transactions or partial?

I would share my complete portfolio transactions since the launch of service in December 2019, with some exceptions as follows-.

- I also have investment in a few risky smallcap/microcap stocks, details of which I share here.

- Another part of my portfolio is invested in foreign stocks which is broadcasted from here.

Also note that I won't share the absolute value of each stock purchased, nor disclose my personal net worth due to obvious reasons. I would share the percentage allocation against each stock.

-

Why research report or price target is NOT offered?

Publishing a research report means due to regulatory norms I can't invest in the same stock within 30 days prior and 5 days after releasing the report. Further, I can't sell in the due course and can sell only after 5 days from releasing the "Sell Report." I can't able to invest freely in all of my own researched stocks as within 5 days or 30 days stock price often cross desired level.

Further, the service is meant for offering an information source. Members are not under any kind of mandate for buying/selling any stock. Thus, there won't be any research reports or any future prediction of the stock price.

-

What if I have some stock specific queries?

Kindly note that no stock specific queries are answered. The service is just offering a glimpse of what I am buying and selling in my personal portfolio. I am no way answerable for my personal investment activities.

Further, my experience of offering advisory service from 2012 to 2019 reveals that investors mostly ask query only while the stock price keeps moving down. I rarely used to receive queries that revolves around stock price moving up. Most of the queries revolves around "Why the price is going down?" Answering queries never help stock price to go up. Moreover, in maximum cases, I find no significant value addition to anyone by answering queries. Thus, stock specific queries are excluded from the service.

Still, if you want to connect with me personally for any kind of doubt clarification related to any aspects of the stock market, you can book an paid appointment from this page. Occasionally, you can expect general emails/updates if there is any significant development.

-

What are the measures you take to address conflict of interest?

The service is just an information offering, not any investment advisory. Members those are interested to know about the personal buy/sell transactions of Prasenjit Paul should only subscribe for the service. However, as an additional measure, I am following the regulation that stipulates -

“An investment advisor shall not enter into transactions on its own account which is contrary to its advice given to clients for a period of fifteen days from the day of such advice.Provided that during the period of such fifteen days, if the investment adviser is of the opinion that the situation has changed, then it may enter into such a transaction on its own account after giving such revised assessment to the client at least 24 hours in advance of entering into such transaction.”

Although I am not acting as an "Investment Advisor" still to avoid any conflict of interest, if I decide to reverse my position of buy or sell in any stock of my portfolio, from the position taken by me within 15 days, then before entering into such reverse position, I would send a notification to all the subscribers at least 24 hours before I enter into such transaction in my portfolio.

-

You might sell a stock due to market/stock specific reasons or due to personal fund requirement. How can I know that?

Mostly, there won't be any sell for personal fund requirement as I have other passive income sources (like book selling) for maintaining daily expenses. I will sell stocks only due to the market specific or stock specific reasons as per my personal judgement. However, in future if I end up selling for my personal fund requirement then it would be notified separately.

Disclosures

The service is not an offer to sell or solicitation to buy any securities. Prasenjit Kumar Paul will not be liable for any losses incurred or investment(s) made or decisions taken/or not taken based on the information provided herein.

The information contained herein does not constitute a personal recommendation or take into account the investment objectives, financial situations, or needs of individual investors. Before acting on any information, investors should consider whether it is suitable for their particular circumstances. Information herein is believed to be reliable but Prasenjit Kumar Paul does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. The performance data quoted represents past performance and does not guarantee future results.